Highlights

• Renascor Resources Limited, Kent Town, Australia, (ASX: RNU), enters into non-binding Memorandum of Understanding (MOU) with one of China’s leading battery anode companies, Jiangxi Zhengtuo New Energy Technology Co. Ltd. (Zeto).

• The MOU follows the recent achievement of First Stage Product Qualification with our first offtake partner Minguang New Material(1) .

• The MOU with Zeto covers the purchase of up to 10,000tpa of Purified Spherical Graphite (PSG) over a 10-year term, which represents approximately one-third of the projected initial PSG production capacity of Renascor’s planned Battery Anode Material operation in South Australia.

• Zeto is a top ten anode producer globally, with current anode production capacity of 30,000tpa(2) and an additional 20,000tpa under construction and planned to be in operation by 2022(3) . Zeto is major supplier of natural flake graphite anodes and is active in developing anode technologies, including silicon-carbon anode material(4) .

• Zeto supplies anodes to some of the world’s largest battery makers, such as Hong Kong listed BYD Co. Ltd, the world’s second largest manufacturer and retailer of electric vehicles(5) , with a current market capitalisation of around US$100 billion(6) .

• China continues to be the dominant market for PSG. Chinese anode production capacity represents around 85% of global capacity and over 90% of capacity currently under construction(7).

• Under the terms of the MOU, Zeto and Renascor have agreed to work together to undertake additional product validation tests prior to concluding a formal binding agreement.

• Renascor is concurrently discussing additional potential PSG offtake agreements and undertaking PSG validation with other anode and battery companies, with a view to securing binding commitments for its planned 28,000tpa PSG operation.

Renascor Resources Limited has signed a second MOU for production of Purified Spherical Graphite (PSG) from its planned Battery Anode Material operation in South Australia. The MOU provides for the supply of up to 10,000tpa of PSG over a period of ten years to Jiangxi Zhengtuo New Energy Technology Co. Ltd. (Zeto), Jiangxi, China, which represents approximately one third of Renascor’s planned annual PSG production capacity of 28,000tpa.

The MOU with Zeto is non-binding and provides the framework for further negotiations in relation to price, product quality and other offtake parameters following completion of additional product validation tests.

Zeto is one of the largest anode producers globally, with current anode production capacity of 30,000tpa(8) . Zeto is currently constructing an additional 20,000tpa of anode capacity, with the expansion to 50,000tpa capacity planned for 2022(9).

Zeto is major supplier of natural flake graphite anodes and is active in research and development of anode technologies. Zeto is the first producer of silicon-carbon anode material in China(10).

Zeto supplies anodes to some of the world’s largest battery makers such as BYD Co. Ltd., whose electric vehicle battery production capacity of 25GWh in 2018 is planned to expand to over 90GWh by 2028(11) . BYD Co. Ltd. Is listed on the Hong Kong Stock Exchange, is part owned by Warren Buffet’s Berkshire Hathaway and has a current market capitalisation of approximately US$100 billion(12).

Commenting on the MOU, Renascor Managing Director David Christensen stated: “Our MOU with Zeto is a further significant step in Renascor’s plans to become a globally competitive Australian producer of battery anode material. Together with our recent offtake MOU with Minguang New Material, these two offtakers will account for up to two-thirds of our planned PSG production.”

“We are particularly pleased to have secured our second PSG offtake agreement with an anode material company affiliated with one of the most technically adept anode technology developers and producers in China, and one who is steeped in the production of natural flake graphite anodes, as well as emerging silicon-composite anodes.”

“China continues to dominate anode production globally, with production capacity of over 600,000tpa, and this makes China the largest PSG consumer in the world. China’s current anode production represents around 85% of global anode production, and with another 560,000tpa of capacity currently under construction, representing over 90% of all new capacity, we expect China to remain a dominant market for PSG into the future.”

“The demand for electric vehicle batteries continues to underpin growing demand for PSG. We are seeing increasing interest from anode makers for our Siviour PSG (Siviour Open Pit Project is located 14 km W from Arno Bay, South Australia), and we expect this to assist in securing additional offtake commitments in line with our financing and development strategy.”

Progress on additional PSG offtake

Renascor is concurrently advancing offtake negotiations for the balance of its planned PSG production capacity, including with anode manufacturers and lithium-ion battery companies headquartered in Northeast Asia and Europe.

While COVID-19 has caused some delays by preventing site visits and in-person meetings, Renascor continues to make progress in relation to PSG offtake, with current activities largely focused on undertaking PSG validation tests, responding to due diligence enquiries and negotiating potential offtake terms.

Lithium-ion battery anode market

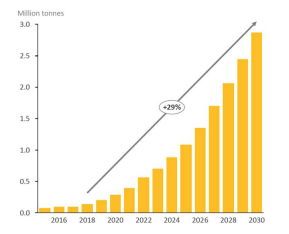

As a result of growth in the electric vehicle and lithium-ion battery markets, the demand for lithium ion battery anodes is also experiencing significant expansion. This has resulted in increased demand for PSG by anode manufacturers, with annual growth rates of up to 29% predicted through to 2030, leading to an increase in the market from approximately 200,000 tonnes in 2019 to 2.4 million tonnes by 202913 (Figure 1).

Figure 1. PSG demand forecast (Source: Benchmark Mineral Intelligence)

The production of lithium-ion battery anodes is largely concentrated in China, which accounts for approximately 85% (600,000tpa) of current lithium-ion battery anode capacity. The remaining 15% of lithium-ion battery anode capacity is centered in South Korea and Japan, with emerging anode production sources being developed in Europe and North America. China is also the highest growth market for lithium-ion battery anodes, with over 90% (560,000tpa) of new capacity currently under construction(13). See Figure 2.

Figure 2. Global anode capacity (Source: Benchmark Mineral Intelligence, January 2021)

Bibliography

1. Renascor ASX announcement dated 12 January 2021, “First Stage Product Qualification with Offtake Partner”

2. Renascor ASX announcement dated 1 July 2020, “Battery Anode Material Study”

1 Source: RNU ASX release, “First Stage Product Qualification with Offtake Partner”, January 2021.

2 Source: Benchmark Mineral Intelligence, “Anode Capacity Index”, January 2021.

3 Source: Jiangxi Zhengtuo New Energy Technology Co., Ltd

4 Source: Jiangxi Zhengtuo New Energy Technology Co., Ltd

5 Source: Forbes, “The Electric Cars to Look out for in 2021”, 9 January 2021 www.forbes.com/sites/jamesmorris/2021/01/09/chinese-electric-vehicles-to-look-out-for-in-2021/?sh=d78905375ddd.

6 Source: Bloomberg (January 2021).

7 Source: Benchmark Mineral Intelligence, “Anode Market Assessment”, January 2021. 8 Source: Benchmark Mineral Intelligence, “Anode Capacity Index”, January 2021.

9 Source: Jiangxi Zhengtuo New Energy Technology Co., Ltd

10 Source: Jiangxi Zhengtuo New Energy Technology Co., Ltd

11 Source: Benchmark Mineral Intelligence (November 2019).

12 Source: Bloomberg (January 2021).

13 Source: Benchmark Mineral Intelligence (2019). 14 Source: Benchmark Mineral Intelligence (2020).